Petrol and Diesel price shot up to an all-time high in India. Primarily reasons are the country’s reliance on imported energy, Increased central and state taxation, as well as an increase in global crude prices. Additionally, The central management raised the excise valuation on petrol from Rs 19.98 to Rs 32.98 per gallon during the pandemic global supply and demand.

The Value Added Tax had also been raised by some state administrations (VAT). Due to a variety of factors, including the current tax regime and support payments by the respective countries, the prices of petroleum goods in India are generally higher-lower than in other countries.

In six states and union regions, petrol and diesel prices have already excelled Rs 100 per liter, majorly due to global supply and demand.

The impact of taxes such as VAT and freight costs on fuel prices varies from state to state. Karnataka, Rajasthan, Madhya Pradesh, Maharashtra, Andhra Pradesh, Bihar, and Telangana have the expensive VAT rates in the country.

Instead of passing on the excise duty hikes to consumers, oil companies Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL), and Hindustan Petroleum Corp Ltd (HPCL) corrected them for the drop in retail allowances that was merited due to the drop in international oil prices.

For a long time, oil companies had abstained from raising fuel rates, owing to low demand in the country due to limited mobility during the pandemic. However, as travel restrictions are progressively removed, fuel consumption has rebounded, and oil corporations are profiting by passing along the cost of the excise duty hike to end consumers.

Petrol prices might be reduced to Rs 75 per liter across the country if the Goods and Services Tax (GST) is executed, but there is a lack of legislative will, which keeps Indian oil product prices among the highest in the world. Petrol and diesel prices are adjusted diurnal based on the 15-day average of the worldwide price of the commodity in question and foreign exchange rates.

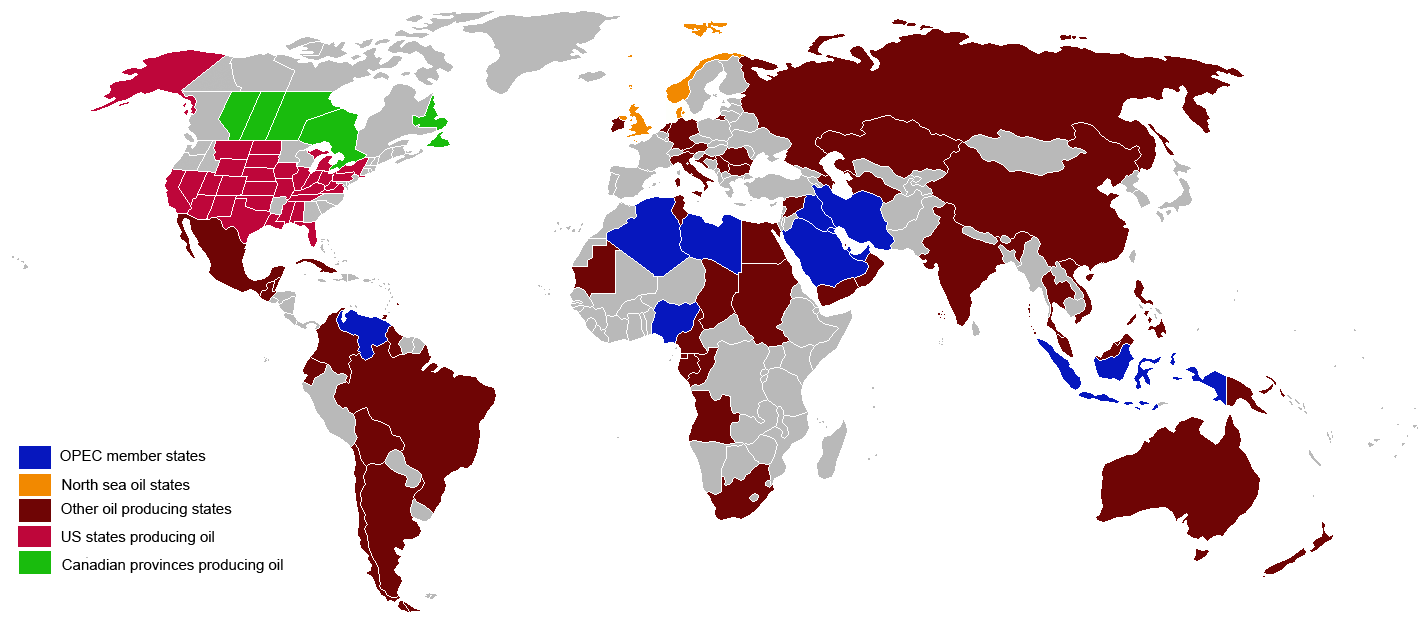

External forces are to blame for the price increase as per Ministry in India. The Organization of Petroleum Exporting Countries (OPEC) had committed to raising output by one million barrels per day, however, this commitment was not kept. Aside from that, crises in nations such as Venezuela and Iran are becoming more common. Oil prices are under pressure as a result of lower production. Second, global currencies have lost ground against the greenback.

In recent days, international gasoline, against which domestic gasoline rates are benchmarked, has shown a firming trend. To offset price increases by Petroleo Brasileiro SA, the Brazilian administration lowered taxes on gasoline and diesel, a move that could help the principal bank meet its 2011 inflation target.

Diesel is a bright spot in an otherwise broken U.S. fuel industry, thanks to a pandemic-driven surge in online buying. Ship containers arriving at unprecedented rates on the West Coast are the latest indication, with products being trucked from Los Angeles to as far as Atlanta far more frequently than a year ago. As consumer purchasing patterns alter, demand for everything from medical facilities to home office supplies to gardening tools is surging. Since Covid, the trucking business has been the crude oil complex’s lone bright spot.

Because India’s gas prices are so high, some gasoline and diesel exported to neighboring nations are smuggled back across porous land borders. Vehicles are now getting their fuel from roadside vendors, who are selling smuggled petrol for a significantly lower price. Because, the hike in diesel will eat up farmer’s profit, and slow down the economic recovery in India. Diesel is the economic driver in rural parts of India.