In this article, We will analyze Shree Cement stock to build a profitable investment portfolio.

Profit Over Tax

Shree Cement has profit over tax 767 crore Indian rupees in March 2021 quarter. The crucial support level 27700. The highest trading volume was 17500 on 6th July. The RSI is close to overbought level 69, hence it is recommended to trade cautiously with new trades.

VaR, Capitalization, Surplus and Book Value

Shree Cement Security VaR( Value at Risk) is 13.25. The market capitalization of Shree Cement is 101,303.92 crore. Shree Cement book value is 4,200 approximately. The reserve surplus cash is estimated around 152100 crore.

52 Week High and Low

Shree Cement 52 week low is 18,183.55 (24-Sep-2020) and 52 week high is (08-Apr-2021) 32,048.00

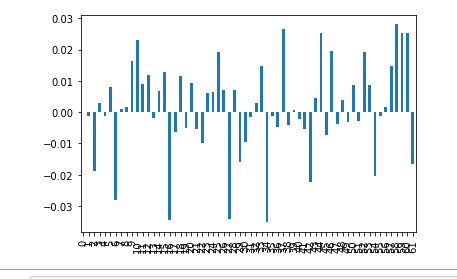

Quarterly Compound Return

Shree Cement compounding interest return for last 3 months is positive 0.41. This means, if you had invest 27000 rupees in the Shree cement stock, the total profit would have been 1135.

Current earning per share (EPS) is valued at 640 INR. The annual general meeting of equity Shree Cement is schedule don 9th August 2021.

Bollinger Bonds

Bollinger bond is appearing at the level of 27800 to 28300. The stock will re-bounce if stock price reach Bollinger bonds level, and if there are no news.

Latest Happening

Shree Cement will establish up Clinker Unit at Baloda Bazar, Raipur in Chhattisgarh with an investment of up to 12,000 tonnes per day. Internal accruals & loans are used to finance the project.

Shree Cement has ultimate monopoly in Cement sector. Only other fierce competitors are ACC Cement, Ultra Tech Cements, and Ambuja Cement.

The credit rating of Shree Cement is placed to CARE A1+, per latest company report. Apart from good rating, Shree Cement has sporting rights some in reputed football sport teams.

Future contract Roll Over contract percentage is 1.55%, and Open Interest is 3.3%. The options derivative data shows long build up in Shree Cement stock.

Considering aforementioned prospect, it is advised to trade with low volume until there is a break out in the Shree Cement stock. If you are already holding some Shree Cement stocks, then it is better to wait for